3 stocking stuffers you can buy for yourself

- Bristol-Meyers Squibb is a deep-value, high-yield name in pharma trading near its floor.

- The S.J. Smucker Company is a sweet treat for dividend growth investors and a value for income investors.

- Investar is trading below the analyst's lowest target, paying 3.85% with a low beta to help offset market volatility.

Stocking stuffers are small, inexpensive presents that help to complete the holiday, so for this screen, the focus was on inexpensive stocks. Inexpensive means a low P/E multiple relative to the S&P 500 (NYSEARCA: SPY), but it doesn’t mean cheap. Each stock on this list is a quality dividend-paying name with a higher-than-average yield to help brighten the season (and portfolio returns). Additionally, the screen criteria include a low beta and stocks trading near their 52-week low to try and capture a bit of sleep-soundly-at-night safety to help offset any worry for the coming year.

Bristol-Myers Squibb and the patent cliff

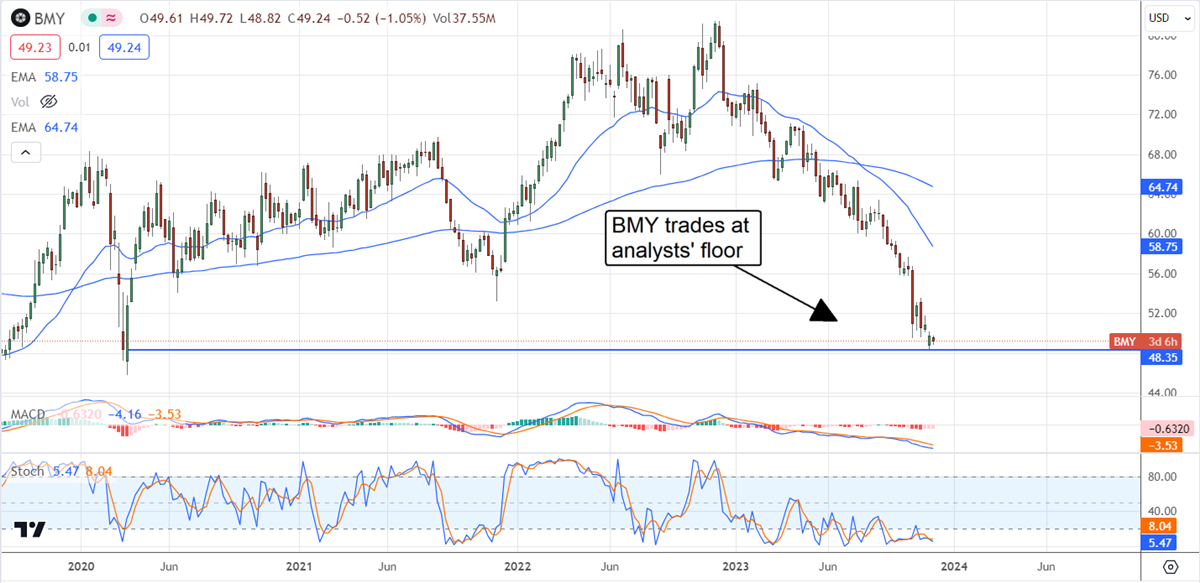

Bristol-Myers Squibb (NYSE: BMY) is struggling with the patent cliff like most other big pharma companies, depressing the market. However, the takeaway from the data suggests the market is oversold and trading near its floor, setting up for a rebound in 2024. While 2023 results show YOY decline, the decline is narrowing sequentially, and growth is expected to return next year.

Regarding the stock screen and metrics, BMY stock is at the top of the list with a low 6.5X valuation, well below its peers, and it pays a solid 4.65%. The dividend is reliably safe for 2024 and can be expected to grow. The yield is compounded by a super-low 0.30 beta, which suggests little to no movement compared to the S&P, and the stock is already trading at its floor.

Analyst's sentiment aided the decline in share prices, but the move has run its course. While analysts have steadily lowered their price targets in 2023, the sentiment has held firm at Hold, and the low end of the range coincides with critical market support. That level is $50, consistent with the COVID-19 lows set in 2020 and a launch pad for higher prices. Among the catalysts for growth is the acquisition of Mirati Therapeutics and its oncology drug, Krazati.

The J.M. Smucker Company is a sweet treat

The J.M. Smucker Company (NYSE: SJM) shares are in deep value territory in more ways than one. Not only does the stock trade near 12X earnings, near the low-end for blue chip consumer staples companies, but it trades about 1000 basis points below the lowest analyst target, which was very recently set. In this scenario, the market is set up to rebound solidly in 2024 because growth is expected to resume. The consensus target for next year is for revenue and earnings to be up 12%, sufficient to sustain the outlook for dividend increases.

SJM stock pays about 3.8%, trading near 12X earnings and only pays 45% of earnings. This leaves ample room on the books to continue with annual increases which already top 25 years. The analysts have helped the stock to fall to its current levels with a series of price target reductions.

However, the analysts have recently upped the consensus sentiment to Hold and see it trading about 30% higher at the consensus price target. The next catalyst will be the FQ2 earnings in early December. The analysts expect a YOY revenue decline but for the margin to expand, and the bar is set low for both.

Investar Holding Corporation Rising; Oversold and overextended value play

Investar Holding Corporation (NASDAQ: ISTR) is the holding corporation for Investar Bank, operating in Southern Louisiana. The share prices are depressed for several reasons, including the bank crisis early in 2023, tepid growth, and its relatively unknown status. However, trading at 5X earnings and paying 3.85% is worth a nibble due to its low 0.20 beta and even lower 18% payout ratio.

Marketbeat tracks 2 analysts with current ratings in 2023, both set since the middle of the year. They rate the stock at Moderate Buy and see it trading well below its target range. A move to the analysts' low target is worth more than 30%, and the consensus figure adds a few hundred basis points.

The chart is promising. Although trading at a long-term low, the indicators show the market diverges from its trend and is set up to rebound. The MACD and stochastic are already firing a bullish signal, so this market could see a substantial rally before the end of the year.